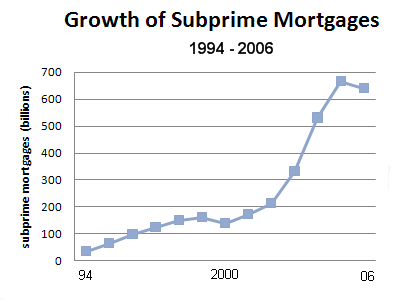

While housing prices and homeownership rates are some of the most frequently used metrics to describe the aggregate health of housing markets, they do not provide direct insight into household-level well-being. Homeowners and renters experienced recession and recovery differently While the timing of the decline and rebound varies some across the six metro areas, most areas did not see a noticeable recovery of prices until 2013. Prices dropped steeply during the Great Recession, followed by several years of gradual declines (Figure 2). Most metro areas (except Los Angeles) have seen homeownership rebound by several percentage points from the lowest point, although not all have returned to their pre-Great Recession peaks. The foreclosure crisis that triggered the Great Recession caused homeownership rates to decline sharply in all six metro areas in this analysis, generally hitting a trough around 2014-nearly five years after the recession officially “ended” (Figure 1). Homeownership rates reached historic heights during the housing boom of the early and mid-2000s, fueled in part by widespread expansion of mortgage availability and loosened underwriting criteria. But two key metrics-housing prices and homeownership rates-show that housing markets continued to worsen for several years. The Great Recession lasted from December 2007 through June 2009. Housing distress lasted well beyond the end of the Great Recession How housing markets in these metro areas recovered from the Great Recession offers some guidance for what to expect over the next few years. Job markets in Las Vegas, Orlando, Fla., and New Orleans depend heavily on tourism and hospitality industries, which are disproportionately suffering in the public health emergency. Los Angeles, Riverside, Calif., Las Vegas, and Phoenix were among the areas foreclosures hit hardest. In this brief, we analyze several measures of housing distress from 2007 to 2019 for six metro areas, chosen based on their housing and labor market characteristics.

Despite this difference, the Great Recession and recovery from it can offer some context and insights into how households and housing markets might fare as the U.S. In that crisis, foreclosures and collapsing prices hit homeowners first, before the recession spread into rental markets. In some ways, the current economic situation is the inverse of the Great Recession. These disparate outcomes in housing market segments mirror the pandemic’s uneven impact on labor markets, with college-educated professionals working from home while low-wage service workers experience the highest rates of job loss. And prices for owner-occupied housing have soared while the inventory of for-sale homes has plummeted. Missed payments are putting pressure on the nation’s already fragile affordable housing supply. Millions of renters have fallen behind on their rent, fearing eviction while accumulating debts they cannot pay. Twitter is difficult to overstate the extent to which the COVID-19 pandemic has wreaked havoc on housing markets.

0 kommentar(er)

0 kommentar(er)